Affordable Care Act: Difference between revisions

m →Health outcomes: comma |

Fixed error I introduced, e.g.: 'Cite error: A list-defined reference named "cbo_est" is not used in the content' a few days ago by updating a table, removing references from the table manually, but not from the list of references. Sorry about that. |

||

| (132 intermediate revisions by 10 users not shown) | |||

| Line 45: | Line 45: | ||

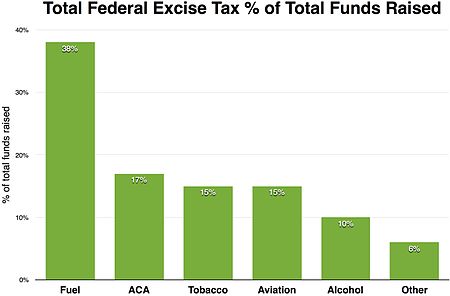

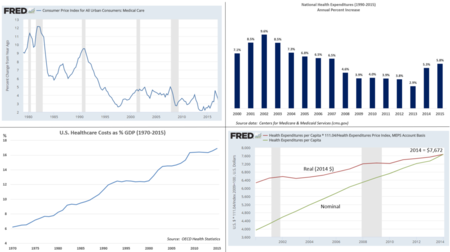

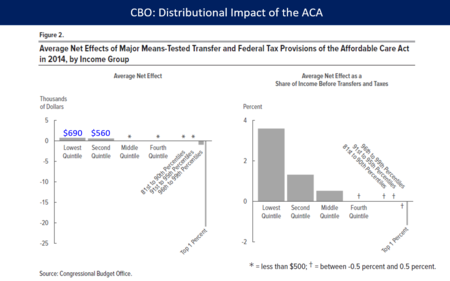

The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered during 2016.<ref name=CBO_Subsidy2016/><ref name="HHS_ASPE16">{{Cite web|url=https://aspe.hhs.gov/pdf-report/health-insurance-coverage-and-affordable-care-act-2010-2016|title=Health Insurance Coverage and the Affordable Care Act, 2010–2016|accessdate=December 7, 2016}}</ref> The increased coverage was due, roughly equally, to an expansion of Medicaid eligibility and to major changes to [[Individually purchased health insurance|individual insurance]] markets. Both involved new spending, funded through a combination of new taxes and cuts to Medicare provider rates and [[Medicare Advantage]]. Several [[Congressional Budget Office]] reports said that overall these provisions reduced the [[Government budget balance|budget deficit]], that repealing the ACA would increase the deficit,<ref name="CBO50252"/><ref name="CBO22077"/> and that the law reduced income inequality by taxing primarily the top 1% to fund roughly $600 in benefits on average to families in the bottom 40% of the income distribution.<ref name="CBO_Dist14"/> The law also enacted a host of [[Healthcare industry#Delivery of services|delivery system]] reforms intended to constrain healthcare costs and improve quality. After the law went into effect, increases in overall healthcare spending slowed, including premiums for employer-based insurance plans.<ref name=Kaiser15/> |

The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered during 2016.<ref name=CBO_Subsidy2016/><ref name="HHS_ASPE16">{{Cite web|url=https://aspe.hhs.gov/pdf-report/health-insurance-coverage-and-affordable-care-act-2010-2016|title=Health Insurance Coverage and the Affordable Care Act, 2010–2016|accessdate=December 7, 2016}}</ref> The increased coverage was due, roughly equally, to an expansion of Medicaid eligibility and to major changes to [[Individually purchased health insurance|individual insurance]] markets. Both involved new spending, funded through a combination of new taxes and cuts to Medicare provider rates and [[Medicare Advantage]]. Several [[Congressional Budget Office]] reports said that overall these provisions reduced the [[Government budget balance|budget deficit]], that repealing the ACA would increase the deficit,<ref name="CBO50252"/><ref name="CBO22077"/> and that the law reduced income inequality by taxing primarily the top 1% to fund roughly $600 in benefits on average to families in the bottom 40% of the income distribution.<ref name="CBO_Dist14"/> The law also enacted a host of [[Healthcare industry#Delivery of services|delivery system]] reforms intended to constrain healthcare costs and improve quality. After the law went into effect, increases in overall healthcare spending slowed, including premiums for employer-based insurance plans.<ref name=Kaiser15/> |

||

The act largely retains the existing structure of Medicare, Medicaid, and the [[Health insurance in the United States#Employer sponsored|employer market]], but individual markets were radically overhauled around a three-legged program.<ref name="Oberlander2010"/><ref name="Gruber2011">{{cite journal |last1=Gruber |first1=Jonathan |title=The Impacts of the Affordable Care Act: How Reasonable Are the Projections? |journal=National Tax Journal |date=2011 |volume=64 |issue=3 |pages=893–908 |url=https://economics.mit.edu/files/11416 |accessdate=23 July 2017 |doi=10.17310/ntj.2011.3.06}}</ref> Insurers in these markets are made to [[Guaranteed issue|accept all applicants]] and [[Community rating|charge the same rates]] regardless of [[pre-existing condition]]s or sex. To combat resultant [[adverse selection]], the act [[Individual shared responsibility provision|mandates]] that individuals buy insurance and insurers cover a list of "[[essential health benefits]]". The [[Tax Cuts and Jobs Act of 2017]] zeroed out the federal tax penalty for violating the individual mandate, starting in 2019. (In order to pass the Senate under [[Reconciliation (United States Congress)|reconciliation rules]] with only 50 votes, the requirement itself is still in effect |

The act largely retains the existing structure of Medicare, Medicaid, and the [[Health insurance in the United States#Employer sponsored|employer market]], but individual markets were radically overhauled around a three-legged program.<ref name="Oberlander2010"/><ref name="Gruber2011">{{cite journal |last1=Gruber |first1=Jonathan |title=The Impacts of the Affordable Care Act: How Reasonable Are the Projections? |journal=National Tax Journal |date=2011 |volume=64 |issue=3 |pages=893–908 |url=https://economics.mit.edu/files/11416 |accessdate=23 July 2017 |doi=10.17310/ntj.2011.3.06|hdl=1721.1/72971 }}</ref> Insurers in these markets are made to [[Guaranteed issue|accept all applicants]] and [[Community rating|charge the same rates]] regardless of [[pre-existing condition]]s or sex. To combat resultant [[adverse selection]], the act [[Individual shared responsibility provision|mandates]] that individuals buy insurance and insurers cover a list of "[[essential health benefits]]". The [[Tax Cuts and Jobs Act of 2017]] zeroed out the federal tax penalty for violating the individual mandate, starting in 2019. (In order to pass the Senate under [[Reconciliation (United States Congress)|reconciliation rules]] with only 50 votes, the requirement itself is still in effect.)<ref name="auto">{{Cite web|url=https://www.commonwealthfund.org/publications/fund-reports/2018/jul/eliminating-individual-mandate-penalty-behavioral-factors|title=The Effect of Eliminating the Individual Mandate Penalty and the Role of Behavioral Factors | Commonwealth Fund|website=www.commonwealthfund.org}}</ref> To help households between 100–400% of the [[Poverty in the United States#Recent poverty rate and guidelines|Federal Poverty Line]] afford these compulsory policies, the law provides [[premium tax credit|insurance premium subsidies]]. Other individual market changes include [[health insurance marketplace|health marketplaces]] and [[Risk equalization|risk adjustment]] programs. |

||

Since being signed into law in 2010, the PPACA has faced strong political opposition, calls for repeal (from [[Republican Party (United States)|Republicans]]) and numerous [[Constitutional challenges to the Patient Protection and Affordable Care Act|legal challenges]]; its enactment is considered to be a catalyst for the [[Tea Party movement]]. In ''[[National Federation of Independent Business v. Sebelius]]'', the [[Supreme Court of the United States|Supreme Court]] ruled that states could choose not to participate in the ACA's Medicaid expansion, although it upheld the law as a whole.<ref name=NatLawReview2012/> The federal [[health exchange]], [[HealthCare.gov]], faced major technical problems at the beginning of its rollout in 2013. In 2017, a unified [[Republican Party (United States)|Republican]] government attempted but failed to pass [[American Health Care Act of 2017|several different]] partial repeals of the ACA. The law spent several years opposed by a slim [[Plurality (voting)|plurality]] of Americans polled, although its provisions were generally more popular than the law as a whole,<ref>{{cite web |last1=Kirzinger |first1=Ashley |last2=Sugarman |first2=Elise |last3=Brodie |first3=Mollyann |title=Kaiser Health Tracking Poll: November 2016 |url=http://www.kff.org/health-costs/poll-finding/kaiser-health-tracking-poll-november-2016/ |publisher=Kaiser Family Foundation |accessdate=23 July 2017 |date=1 December 2016}}</ref> and the law gained majority support by 2017.<ref>{{cite news |title=Gallup: ObamaCare has majority support for first time |url=http://thehill.com/policy/healthcare/327267-poll-obamacare-has-majority-support-for-first-time |accessdate=18 November 2017 |work=The Hill |language=en}}</ref> |

Since being signed into law in 2010, the PPACA has faced strong political opposition, calls for repeal (from [[Republican Party (United States)|Republicans]]) and numerous [[Constitutional challenges to the Patient Protection and Affordable Care Act|legal challenges]]; its enactment is considered to be a catalyst for the [[Tea Party movement]]. In ''[[National Federation of Independent Business v. Sebelius]]'', the [[Supreme Court of the United States|Supreme Court]] ruled that states could choose not to participate in the ACA's Medicaid expansion, although it upheld the law as a whole.<ref name=NatLawReview2012/> The federal [[health exchange]], [[HealthCare.gov]], faced major technical problems at the beginning of its rollout in 2013. In 2017, a unified [[Republican Party (United States)|Republican]] government attempted but failed to pass [[American Health Care Act of 2017|several different]] partial repeals of the ACA. The law spent several years opposed by a slim [[Plurality (voting)|plurality]] of Americans polled, although its provisions were generally more popular than the law as a whole,<ref>{{cite web |last1=Kirzinger |first1=Ashley |last2=Sugarman |first2=Elise |last3=Brodie |first3=Mollyann |title=Kaiser Health Tracking Poll: November 2016 |url=http://www.kff.org/health-costs/poll-finding/kaiser-health-tracking-poll-november-2016/ |publisher=Kaiser Family Foundation |accessdate=23 July 2017 |date=1 December 2016}}</ref> and the law gained majority support by 2017.<ref>{{cite news |title=Gallup: ObamaCare has majority support for first time |url=http://thehill.com/policy/healthcare/327267-poll-obamacare-has-majority-support-for-first-time |accessdate=18 November 2017 |work=The Hill |language=en}}</ref>{{TOC limit|3}} |

||

== Outline of Coverage Mechanism == |

|||

{{TOC limit|3}} |

|||

An intent of the ACA is to make coverage available to all, regardless of whether they have pre-existing health conditions, at an affordable cost. This is done by (for the case of U.S. citizens<ref>{{Cite web|url=https://www.healthcare.gov/immigrants/lawfully-present-immigrants/#targetText=Lawfully%20present%20immigrants%20and%20Marketplace%20savings&targetText=You%20may%20be%20eligible%20for,other%20savings%20on%20Marketplace%20insurance.|title=Health coverage for lawfully present immigrants|website=HealthCare.gov|language=en|access-date=2019-08-24}}</ref><ref name=":8" />): |

|||

# Expanding employer coverage through the [[Patient Protection and Affordable Care Act#Employer mandate|Employer mandate]], |

|||

==Provisions== |

|||

# Retaining existing [[Medicaid]] programs ("traditional Medicaid"; which generally required both low incomes and very low asset levels), and also [[Children's Health Insurance Program|Children's Health Insurance Programs (CHIPs)]], |

|||

{{Main|Provisions of the Patient Protection and Affordable Care Act}} |

|||

# Starting a new class of [[Medicaid]], [[Patient Protection and Affordable Care Act#Medicaid expansion|expanded Medicaid,]] for people whose Modified Adjusted Gross Incomes (MAGIs) are no more than 138% of the Federal Poverty Level (FPL)<ref name=":4">{{Cite web|url=https://www.payingforseniorcare.com/longtermcare/federal-poverty-level.html|title=2019 Federal Poverty Guidelines / Federal Poverty Levels|website=www.payingforseniorcare.com|access-date=2019-08-10}}</ref> and with no maximum asset levels<ref>{{Cite web|url=https://www.healthinsurance.org/glossary/medicaid-expansion/|title=Medicaid expansion definition|date=2018-11-19|website=healthinsurance.org|language=en|access-date=2019-08-10}}</ref>, |

|||

#[[Patient Protection and Affordable Care Act#Insurance_regulations:_individual_policies|Requiring individual major medical policies]] from private insurers to accept all people regardless of pre-existing conditions, and to not consider pre-existing conditions in rates charged. Rates may vary depending on age, but the maximum ratio of premiums for the oldest to the youngest covered are capped at 3 to 1<ref name=":45" />. (The ACA attempted to be make the policies provide strong coverage by requiring essential benefits, and by not allowing yearly or lifetime caps on coverage, as well as having maximum annual out-of-pocket payment caps.) |

|||

# For people who do not have coverage available by other means (an affordable employer's or a family member's employer insurance program, or the items in (2) and(3) above: a traditional Medicaid or expanded Medicaid or a CHIP or other public assistance health coverage), if their MAGIs are from 100% to 400% of the FPL<ref name=":4" />, [[Patient Protection and Affordable Care Act#Subsidies|sliding-scale income-based subsidies]] are provided<ref name=":8">{{Cite web|url=https://www.kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health/|title=Explaining Health Care Reform: Questions About Health Insurance Subsidies|last=Nov 20|first=Published|last2=2018|date=2018-11-20|website=The Henry J. Kaiser Family Foundation|language=en-us|access-date=2019-08-10}}</ref>. |

|||

Essentially, for people without employer insurance, if incomes are through 138% of the FPL, the ACA design intends all people either get Medicaid coverage, or expanded Medicaid coverage. For the remaining individuals, a major medical policy will be available, with a sliding-scale subsidy for individuals with incomes below 400% FPL, to attempt to make the policy affordable. |

|||

Part of the mechanism was also from a mandate to carry coverage (or else pay a penalty). This was designed to keep insurance costs lower than they would otherwise be, by limiting [[adverse selection]] due people just picking up insurance when they got sick, or if they were more likely to get sick. |

|||

It should be noted that, while the intent of the ACA's design was to provided affordable coverage to all, it was not designed to lower premiums for all people. Certain individuals were expected to pay higher, but still affordable, premiums, compared to what they would have without the ACA. A specific case of this would be people who had no pre-existing conditions, and might have, without the ACA, been able to purchase pre-existing-condition-screened insurance at a low premium, made possible by the fact that the pool of people insured by the policy had few sick people in it. The ACA, by requiring people with pre-existing conditions also to be covered by all plans at the same premium, would yield higher raw (before-subsidy) policy premiums for the people without pre-existing conditions. In the case where incomes were greater than 400% of the FPL, there is no subsidy under the ACA, so the post-ACA premiums that have to be paid by the individual would be higher. However, the theory would be that, did those same people need insurance when they had serious pre-existing conditions, they would often then be better off post ACA. For example, in 2012 (the next to the last year before the main ACA provisions went into effect) in Connecticut, the only alternative for individual insurance coverage for people with substantial pre-existing conditions would have been the high-risk-pools, which had rates as high as as $2077.18 a month per person (male 60 to 64) for $7500 out-of-pocket-maximum coverage,<ref>{{Cite web|url=https://web.archive.org/web/20120606085707/http://www.hract.org/hra/Rates/2012/Individual/IndPPORates.htm|title=Health Reinsurance Association|date=2012-06-06|website=web.archive.org|access-date=2019-08-25}}</ref> and $3908.02 a month for the $1000 out-of-pocket-maximum coverage<ref>{{Cite web|url=https://web.archive.org/web/20120429071912/http://www.hract.org/hra/Rates/2012/Individual/IndSHCPRates.htm|title=Health Reinsurance Association|date=2012-04-29|website=web.archive.org|access-date=2019-08-25}}</ref> (same male 60 to 64 in the ACA-unsubsidized income-greater-than-400%-FPL case). |

|||

'''Impediments and Imperfections to Design:''' |

|||

While provisions (4) for individual major medical policies are designed to make them strong policies with good coverage, other coverage post-ACA may not be so strong. |

|||

Large group employer policies are not regulated by the ACA, and may provide weaker coverage. |

|||

In addition, in certain states, coverage under the traditional Medicaid and expanded Medicaid programs is subject to [[Medicaid estate recovery]] of all medical expenses that were paid out for a person while they had Medicaid or expanded Medicaid. The recovery is from a person's estate when they die, and applies only if they were 55 or older when they had the coverage<ref name=":5">{{Cite web|url=https://www.medicaid.gov/medicaid/eligibility/estate-recovery/index.html|title=Estate Recovery and Liens|website=www.medicaid.gov|language=en-us|access-date=2019-08-10}}</ref> <ref name=":6">{{Cite web|url=https://www.elderlawanswers.com/medicaids-power-to-recoup-benefits-paid-estate-recovery-and-liens-12018|title=Medicaid's Power to Recoup Benefits Paid: Estate Recovery and Liens|website=ElderLawAnswers|language=en|access-date=2019-08-10}}</ref> <ref name=":7">{{Citation|title=Medicaid estate recovery|date=2019-08-09|url=https://en.wikipedia.org/w/index.php?title=Medicaid_estate_recovery&oldid=910009004|work=Wikipedia|language=en|access-date=2019-08-10}}</ref> (Individuals who are eligible for Medicaid or expanded Medicaid are not eligible to receive the subsidies described in (5) above. They can avoid the estate recovery, by purchasing the major medical policies described in (4), without a subsidy, subject to whether they can afford it.) |

|||

In a 2012 Supreme Court decision<ref>{{Citation|title=National Federation of Independent Business v. Sebelius|date=2019-08-16|url=https://en.wikipedia.org/w/index.php?title=National_Federation_of_Independent_Business_v._Sebelius&oldid=911012253|work=Wikipedia|language=en|access-date=2019-08-20}}</ref>, it was made optional for states to expand Medicaid, rather than mandatory, as intended. This has resulted in a coverage gap for many of those who were intended to covered by expanded Medicaid<ref>{{Cite web|url=https://www.kff.org/medicaid/issue-brief/the-coverage-gap-uninsured-poor-adults-in-states-that-do-not-expand-medicaid/|title=The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid|last=Orgera|first=Kendal|last2=Mar 21|first2=Anthony Damico Published:|date=2019-03-21|website=The Henry J. Kaiser Family Foundation|language=en-us|access-date=2019-08-20|last3=2019}}</ref>. |

|||

Many states which have expanded Medicaid have, since 2014, have sought and received Federal waivers to add work-requirements for the receipt of Medicaid and expanded Medicaid, which interfere with the original intent.<ref>{{Cite web|url=https://www.kff.org/medicaid/issue-brief/medicaid-waiver-tracker-approved-and-pending-section-1115-waivers-by-state/|title=Medicaid Waiver Tracker: Approved and Pending Section 1115 Waivers by State|last=Aug 09|first=Published:|last2=2019|date=2019-08-09|website=The Henry J. Kaiser Family Foundation|language=en-us|access-date=2019-08-20}}</ref> |

|||

Removal of the mandate to carry coverage (effective in 2019<ref name=":30" />) may increase increase adverse selection in states which do not have their own mandate to carry coverage, increasing costs of individual major medical policies, particularly for those not eligible for the ACA's federal subsidies. |

|||

== Specific Provisions == |

|||

<br />{{See also|Provisions of the Patient Protection and Affordable Care Act}} |

|||

[[File:Barack Obama reacts to the passing of Healthcare bill.jpg|thumb|The President and White House Staff react to the House of Representatives passing the bill on March 21, 2010.]] |

[[File:Barack Obama reacts to the passing of Healthcare bill.jpg|thumb|The President and White House Staff react to the House of Representatives passing the bill on March 21, 2010.]] |

||

[[File:View From the Speaker's Office Tonight (4452690853).jpg|thumb|right|[[Jim Clyburn]] and Nancy Pelosi celebrating after the House passes the amended bill on March 21]] |

[[File:View From the Speaker's Office Tonight (4452690853).jpg|thumb|right|[[Jim Clyburn]] and Nancy Pelosi celebrating after the House passes the amended bill on March 21]] |

||

The ACA includes provisions |

The ACA includes provisions taking effect from 2010 to 2020, although most took effect on January 1, 2014. It amended the [[Public Health Service Act of 1944]] and inserted new provisions on affordable care into [[Title 42 of the United States Code]].{{citation needed|date=December 2017}} Few areas of the US health care system were left untouched, making it the most sweeping health care reform since the [[Social Security Amendments of 1965|enactment]] of [[Medicare (United States)|Medicare]] and [[Medicaid]] in 1965.<ref name="Oberlander2010">{{cite journal |last1=Oberlander |first1=Jonathan |title=Long Time Coming: Why Health Reform Finally Passed |journal=Health Affairs |date=1 June 2010 |volume=29 |issue=6 |pages=1112–1116 |doi=10.1377/hlthaff.2010.0447 |pmid=20530339 |language=en |issn=0278-2715 |df=mdy-all }}</ref><ref name="Blumenthal2015">{{cite journal |last1=Blumenthal |first1=David |last2=Abrams |first2=Melinda |last3=Nuzum |first3=Rachel |title=The Affordable Care Act at 5 Years |journal=New England Journal of Medicine |date=18 June 2015 |volume=372 |issue=25 |pages=2451–2458 |doi=10.1056/NEJMhpr1503614 |pmid=25946142 |issn=0028-4793}}</ref><ref name="CohenEtAl">{{cite book |last1=Cohen |first1=Alan B. |last2=Colby |first2=David C. |last3=Wailoo |first3=Keith A. |last4=Zelizer |first4=Julian E. |title=Medicare and Medicaid at 50: America's Entitlement Programs in the Age of Affordable Care |date=1 June 2015 |publisher=Oxford University Press |isbn=9780190231569 |url=https://books.google.com/books?id=H9DGBwAAQBAJ |language=en}}</ref><ref name="NYTsigning">{{cite news |last1=Stolberg |first1=Sheryl Gay |last2=Pear |first2=Robert |title=Obama Signs Health Care Overhaul Into Law |url=https://www.nytimes.com/2010/03/24/health/policy/24health.html |work=The New York Times |date=23 March 2010}}</ref><ref name="ReutersSCOTUS">{{cite news |last1=Vicini |first1=James |last2=Stempel |first2=Jonathan |last3=Biskupic |first3=Joan |title=Top court upholds healthcare law in Obama triumph |url=https://www.reuters.com/article/us-usa-healthcare-court-idUSBRE85R06420120628 |work=Reuters |date=28 June 2017}}</ref> However, some areas were more affected than others. The individual insurance market was radically overhauled, and many of the law's regulations applied specifically to this market,<ref name="Oberlander2010"/> while the structure of Medicare, Medicaid, and the [[Health insurance in the United States#Employer sponsored|employer market]] were largely retained.<ref name="Blumenthal2015"/> Most of the coverage gains were made through the expansion of Medicaid,<ref>{{cite news |last1=Greenberg |first1=Jon |title=Rand Paul goes too far on Obamacare Medicaid growth |url=http://www.politifact.com/truth-o-meter/statements/2017/jan/15/rand-paul/medicaid-expansion-drove-health-insurance-coverage/ |work=politifact |date=15 January 2017 |language=en}}</ref> and the biggest cost savings were made in Medicare.<ref name="Blumenthal2015"/> Some regulations applied to the employer market, and the law also made delivery system changes that affected most of the health care system.<ref name="Blumenthal2015"/> Not all provisions took full effect. Some were made discretionary, some were deferred, and others were repealed before implementation. |

||

=== Insurance regulations: individual policies === |

|||

The following applies to all new individual major medical health insurance policies sold to individuals and families (whether offered on an ACA exchanges, or off exchange), and referred to generally as ACA-compliant plans.<ref>{{Cite web|url=https://www.healthinsurance.org/glossary/aca-compliant-coverage/|title=ACA-compliant coverage definition|date=2016-05-12|website=healthinsurance.org|language=en|access-date=2019-08-10}}</ref> |

|||

The requirements began Jan 1, 2014. |

|||

===Insurance regulations=== |

|||

* [[Guaranteed issue]] prohibits insurers from denying coverage to individuals due to [[pre-existing condition]]s. States were required to ensure the availability of insurance for individual children who did not have coverage via their families. |

* [[Guaranteed issue]] prohibits insurers from denying coverage to individuals due to [[pre-existing condition]]s. States were required to ensure the availability of insurance for individual children who did not have coverage via their families. |

||

* Premiums must be the same for everyone of a given age, regardless of preexisting conditions. Premiums are allowed to vary by enrollee age, but those for the oldest enrollees (age 45–64, average expenses $5,542) can only be three times as large as those for adults 18–24 ($1,836).<ref>{{cite web |last1=Amadeo |first1=Kimberly |title=How Much Will Obamacare Cost Me |url=https://www.thebalance.com/how-much-will-obamacare-cost-me-3306054 |website=The Balance |accessdate=November 11, 2016}}</ref> |

* Premiums must be the same for everyone of a given age, regardless of preexisting conditions. Premiums are allowed to vary by enrollee age, but those for the oldest enrollees (age 45–64, average expenses $5,542) can only be three times as large as those for adults 18–24 ($1,836).<ref>{{cite web |last1=Amadeo |first1=Kimberly |title=How Much Will Obamacare Cost Me |url=https://www.thebalance.com/how-much-will-obamacare-cost-me-3306054 |website=The Balance |accessdate=November 11, 2016}}</ref> |

||

| Line 67: | Line 98: | ||

* Prohibits insurers from dropping [[policyholder]]s when they get sick.<ref name="Top 18" /> |

* Prohibits insurers from dropping [[policyholder]]s when they get sick.<ref name="Top 18" /> |

||

* All health policies sold in the United States must provide an annual maximum out of pocket (MOOP) payment cap for an individual's or family's medical expenses (excluding premiums). After the MOOP payment cap is reached, all remaining costs must be paid by the insurer.<ref>{{cite web |title=How do out-of-pocket maximums work? |publisher=[[Blue Cross Blue Shield of Michigan]] |url=http://www.bcbsm.com/index/health-insurance-help/faqs/topics/how-health-insurance-works/out-of-pocket-maximums.html}}</ref> |

* All health policies sold in the United States must provide an annual maximum out of pocket (MOOP) payment cap for an individual's or family's medical expenses (excluding premiums). After the MOOP payment cap is reached, all remaining costs must be paid by the insurer.<ref>{{cite web |title=How do out-of-pocket maximums work? |publisher=[[Blue Cross Blue Shield of Michigan]] |url=http://www.bcbsm.com/index/health-insurance-help/faqs/topics/how-health-insurance-works/out-of-pocket-maximums.html}}</ref> |

||

* A partial [[community rating]] requires insurers to offer the same premium to all applicants of the same age and location without regard to gender or most pre-existing conditions (excluding [[tobacco]] use).<ref name=75FR37187/><ref name=Pool/><ref name=Nursingworld.org/> Premiums for older applicants can be no more than three times those for the youngest.<ref>{{cite web |title=Age Band Rating (ACA) |publisher=[[National Association of Personal Financial Advisors]] |url=http://www.naifa.org/practice-resources/prp/age-band-rating-(aca)}}</ref> |

* A partial [[community rating]] requires insurers to offer the same premium to all applicants of the same age and location without regard to gender or most pre-existing conditions (excluding [[tobacco]] use).<ref name=75FR37187/><ref name=Pool/><ref name=Nursingworld.org/> Premiums for older applicants can be no more than three times those for the youngest.<ref name=":45">{{cite web |title=Age Band Rating (ACA) |publisher=[[National Association of Personal Financial Advisors]] |url=http://www.naifa.org/practice-resources/prp/age-band-rating-(aca)}}</ref> |

||

* Preventive care, vaccinations and medical screenings cannot be subject to [[Copayment|co-payments]], [[Co-insurance#In health insurance|co-insurance]] or [[Deductible#Health and travel insurance|deductibles]].<ref name=SHNS/><ref name=KaiserSummary/><ref name=cmsprev/> Specific examples of covered services include: [[mammograms]] and [[Colonoscopy|colonoscopies]], wellness visits, [[gestational diabetes]] screening, [[human papillomavirus|HPV]] testing, [[sexually transmitted infection|STI]] counseling, [[human immunodeficiency virus|HIV]] screening and counseling, contraceptive methods, breastfeeding support/supplies and [[domestic violence]] screening and counseling.<ref name=SchiffHardinLLP/>{{anchor|Platinum plan}} |

* Preventive care, vaccinations and medical screenings cannot be subject to [[Copayment|co-payments]], [[Co-insurance#In health insurance|co-insurance]] or [[Deductible#Health and travel insurance|deductibles]].<ref name=SHNS/><ref name=KaiserSummary/><ref name=cmsprev/> Specific examples of covered services include: [[mammograms]] and [[Colonoscopy|colonoscopies]], wellness visits, [[gestational diabetes]] screening, [[human papillomavirus|HPV]] testing, [[sexually transmitted infection|STI]] counseling, [[human immunodeficiency virus|HIV]] screening and counseling, contraceptive methods, breastfeeding support/supplies and [[domestic violence]] screening and counseling.<ref name=SchiffHardinLLP/>{{anchor|Platinum plan}} |

||

* The law established four tiers of coverage: bronze, silver, gold and platinum. All categories offer the essential health benefits. The categories vary in their division of premiums and out-of-pocket costs: bronze plans have the lowest monthly premiums and highest out-of-pocket costs, while platinum plans are the reverse.<ref name=KaiserEHB/><ref name=choose/> The percentages of [[health care prices in the United States|health care costs]] that plans are expected to cover through premiums (as opposed to out-of-pocket costs) are, on average: 60% (bronze), 70% (silver), 80% (gold), and 90% (platinum).<ref>{{cite web |url=https://www.healthcare.gov/glossary/health-plan-categories/ |title=Health Plan Categories |publisher=HealthCare.Gov, managed by the [[Centers for Medicare and Medicaid Services]]}}</ref> |

* The law established four tiers of coverage: bronze, silver, gold and platinum. All categories offer the essential health benefits. The categories vary in their division of premiums and out-of-pocket costs: bronze plans have the lowest monthly premiums and highest out-of-pocket costs, while platinum plans are the reverse.<ref name=KaiserEHB/><ref name=choose/> The percentages of [[health care prices in the United States|health care costs]] that plans are expected to cover through premiums (as opposed to out-of-pocket costs) are, on average: 60% (bronze), 70% (silver), 80% (gold), and 90% (platinum).<ref>{{cite web |url=https://www.healthcare.gov/glossary/health-plan-categories/ |title=Health Plan Categories |publisher=HealthCare.Gov, managed by the [[Centers for Medicare and Medicaid Services]]}}</ref> |

||

| Line 93: | Line 124: | ||

On December 20, 2017, President Trump signed into law the [[Tax Cuts and Jobs Act of 2017]],<ref name="hatchsays" /> which zeroed out the federal tax penalty for violating the individual mandate, starting in 2019. (In order to pass the Senate under [[Reconciliation (United States Congress)|reconciliation rules]] with only 50 votes, the requirement itself is still in effect).<ref name="auto"/> |

On December 20, 2017, President Trump signed into law the [[Tax Cuts and Jobs Act of 2017]],<ref name="hatchsays" /> which zeroed out the federal tax penalty for violating the individual mandate, starting in 2019. (In order to pass the Senate under [[Reconciliation (United States Congress)|reconciliation rules]] with only 50 votes, the requirement itself is still in effect).<ref name="auto"/> |

||

===Subsidies=== |

===Premium Subsidies=== |

||

Individuals whose household incomes are between 100% and 400% of the [[federal poverty level]] are eligible to receive [[subsidy|federal subsidies]] applied towards premiums for policies purchased via an exchange, provided they are not eligible for [[Medicare (United States)|Medicare]], [[Medicaid]] (including the ACA's expanded Medicaid), the [[Children's Health Insurance Program]], or other forms of public assistance health coverage, and provided also they do not have access to affordable (currently no more than 9.86% MAGI for ''just the employee's coverage'') coverage through their own or a family member's employer. <ref name=KaiserFamily/><ref name=TamiLuhby/><ref name="hip-dhhs" /> Households below the federal poverty level are not eligible to receive federal subsidies. (Except, lawfully present immigrants whose household income is below 100% FPL and are not otherwise eligible for Medicaid are eligible for tax subsidies if they meet all other eligibility requirements<ref>{{Cite web|url=https://www.healthcare.gov/immigrants/lawfully-present-immigrants/#targetText=Lawfully%20present%20immigrants%20and%20Marketplace%20savings&targetText=You%20may%20be%20eligible%20for,other%20savings%20on%20Marketplace%20insurance.|title=Health coverage for lawfully present immigrants|website=HealthCare.gov|language=en|access-date=2019-08-24}}</ref><ref name="KaiserFamily" />.) Married individuals must file taxes jointly in order to receive federal subsidies. Enrollees must have U.S. citizenship or proof of legal residency to obtain a subsidy. |

|||

Subsidies are provided as an advanceable, [[Tax credit#State tax credits|refundable tax credits]].<ref name="sec1401" /><ref name="sec1401_p" /> |

|||

The amount of subsidy is calculated to make the second lowest cost silver plan (SCLSP) on the exchange cost a sliding-scale percentage of Modified Adjusted Gross Income (MAGI). The sliding-scale percentage is based on the percent of Federal Poverty Level (FPL) for the household, and varies slightly from year to year. In 2019, it ranges from 2.08% of MAGI (100%-133% FPL) to 9.86% of MAGI (300%-400% FPL), outside of Alaska and Hawaii.<ref name="hip-dhhs" /> |

|||

The requirement to get a subsidy, do not have access to affordable (currently no more than 9.86% MAGI for ''just the employee's coverage'') employer coverage may leave a family with no option for affordable coverage. That is, the employer coverage for the ''whole family,'' could be, say, 25% of MAGI, making it unaffordable. This issue is called the ''family glitch''.<ref name=":27">{{Cite web|url=https://khn.org/news/fixing-obamacares-family-glitch-hinges-on-outcome-of-november-elections/|title=Fixing Obamacare's 'Family Glitch' Hinges On Outcome Of November Elections|last=Luthra|first=Shefali|date=2018-10-23|website=Kaiser Health News|language=en-US|access-date=2019-08-13}}</ref> |

|||

Additionally, small businesses are eligible for a tax credit provided that they enroll in the [[Small Business Health Options Program|SHOP]] Marketplace.<ref name="IRSBusinessSubsidy" /> |

|||

{| class="wikitable" style="margin: 1em auto 1em auto" |

{| class="wikitable" style="margin: 1em auto 1em auto" |

||

|+ Subsidies ( |

|+Maximum Net Premium After Subsidies (2019) for Family of 4<ref name=":8" /> |

||

|- |

|- |

||

! Income % of [[federal poverty level]] |

! Income % of [[federal poverty level]] |

||

! Premium Cap as a Share of Income |

! Premium Cap as a Share of MAGI Income |

||

! Income{{ref|fedpovlevel|a}} |

! Income{{ref|fedpovlevel|a}}(MAGI) |

||

! |

! Maximum Annual Net Premium After Subsidy |

||

(Second Lowest Cost Silver Plan) |

|||

! Premium Savings{{ref|fedpovlevelb|b}} |

|||

! Additional Cost-Sharing Subsidy |

|||

|- |

|- |

||

| 133% |

| 133% |

||

| 3% of income |

| 3.11% of income |

||

| $ |

| $33,383 |

||

| $ |

| $1,038 |

||

| $10,345 |

|||

| $5,040 |

|||

|- |

|- |

||

| 150% |

| 150% |

||

| 4% of income |

| 4.15% of income |

||

| $ |

| $37,650 |

||

| $1, |

| $1,562 |

||

| $9,918 |

|||

| $5,040 |

|||

|- |

|- |

||

| 200% |

| 200% |

||

| 6. |

| 6.54% of income |

||

| $ |

| $50,200 |

||

| $ |

| $3,283 |

||

| $8,366 |

|||

| $4,000 |

|||

|- |

|- |

||

| 250% |

| 250% |

||

| 8. |

| 8.36% of income |

||

| $ |

| $62,750 |

||

| $ |

| $5,246 |

||

| $6,597 |

|||

| $1,930 |

|||

|- |

|- |

||

| 300% |

| 300% |

||

| 9. |

| 9.86% of income |

||

| $ |

| $75,300 |

||

| $ |

| $7,425 |

||

| $4,628 |

|||

| $1,480 |

|||

|- |

|||

| 350% |

|||

| 9.5% of income |

|||

| $77,175 |

|||

| $7,332 |

|||

| $3,512 |

|||

| $1,480 |

|||

|- |

|- |

||

| 400% |

| 400% |

||

| 9. |

| 9.86% of income |

||

| $ |

| $100,400 |

||

| $ |

| $9,899 |

||

| $2,395 |

|||

| $1,480 |

|||

|- |

|- |

||

| colspan=" |

| colspan="4" style="text-align:left; background:white; border-top:1px solid black; padding:0 1em;" | |

||

<small>a.{{note|fedpovlevel}}Note: In |

<small>a.{{note|fedpovlevel}}Note: In 2019, the Federal Poverty Level was $25,100 for family of four.</small><ref name=":8" /> |

||

b.{{note|fedpovlevelb}}[[DHHS]] and [[Congressional Budget Office|CBO]] estimate the average annual premium cost in 2014 would have been $11,328 for a family of 4 without the reform.<ref name="hip-dhhs" /></small> |

|||

|} |

|} |

||

=== Cost-sharing Reductions === |

|||

Separate from premium subsidies, people eligible for premium subsidies, who, in addition, have Modified Adjusted Gross Incomes (MAGIs) between 100% and 250% of the Federal Poverty Level (FPL), receive also, if they purchase silver plans, cost-sharing reductions (CSRs) on their policies. This means the policies have reduced out-of-pocket maximums, and the policies must have increased actuarial values, which tend to give them reduced copayments compared to policies without cost-sharing reductions<ref name=":42">{{Cite web|url=https://www.kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health/|title=Explaining Health Care Reform: Questions About Health Insurance Subsidies|last=Nov 20|first=Published:|last2=2018|date=2018-11-20|website=The Henry J. Kaiser Family Foundation|language=en-US|access-date=2019-08-25}}</ref>. |

|||

The reduced out-of-pocket maximums, and increased actuarial values, are on a sliding scale. |

|||

For 2019, silver plans normally have a maximum copay of $7900 / $15,800 (individual/family), and have a required actuarial coverage value of 70%. For for individuals with MAGIs of 100-150% MAGI, the maximum copay is $2,600 / $5,200, and the required actuarial coverage is 94%. For individuals with MAGIs of 200-250% MAGI, the maximum copay is $6,300 / $12,600, and the required actuarial coverage is 73%.<ref name=":42" /> |

|||

Before 2018, cost-sharing-reductions were funded directly by payments of the Federal government to insurers, so that the cost of silver plans did not need to be higher than what they would have been without cost-sharing reductions. |

|||

President Trump, by executive action on October 12, 2017,<ref name=":43" /> ended the direct payment by the Federal governments to insurers, effective Jan 1, 2018. At the time of action, it was observed that this would necessitate the raising of premiums on at least some health plans, and possibly all plans. |

|||

However, many states reacted to the loss of the Federal payments to insurers by either directing, or allowing, insurance companies to assess the actuarial costs of the lost Federal CSR payments to silver plans only, or sometimes, to silver plans purchased on the exchange only<ref name=":29" /><ref name=":28" />. (The practice was called "silver loading".) |

|||

Where there is silver loading, the effect is to often give people who received premium subsidies who purchased silver plans, roughly the same net-of-premium-subsidy costs as before the Federal payments were stopped. (This is because premium subsides are determined by a formula to make the second lowest cost silver plan cost a certain fixed percentage of MAGI, so that the increased premiums were accompanied by a commensurately increased subsidy.) |

|||

Further, where there is silver loading, premiums for bronze, gold, and platinum plans are unchanged. (So a person not receiving a subsidy could avoid increased costs by avoiding silver plans.) |

|||

(Note that it may be possible for a Presidential administration to ban silver loading in the future, so in that case, the consequences of the lost CSR payments would be more severe.<ref name=":28" />) |

|||

It should also be noted in the cases of states or insurers who did not do silver loading, the cost of all plans will increase, and this will yield increased costs to those who receive no premium subsidy |

|||

Cost-sharing reductions are also sometimes called cost-sharing subsidies.<ref>{{Cite web|url=https://www.healthinsurance.org/obamacare/the-acas-cost-sharing-subsidies/|title=The ACA’s cost-sharing subsidies|date=2019-06-21|website=healthinsurance.org|language=en|access-date=2019-08-25}}</ref> |

|||

===Exchanges=== |

===Exchanges=== |

||

Established the creation of [[#Insurance exchanges and the individual mandate|health insurance exchanges]] in all fifty states. The exchanges are regulated, largely online marketplaces, administered by either federal or state government, where individuals and small business can purchase private insurance plans.<ref name=HealthCareGov/><ref name=aphabasics/><ref name=CohnExchanges/> |

Established the creation of [[#Insurance exchanges and the individual mandate|health insurance exchanges]] in all fifty states. The exchanges are regulated, largely online marketplaces, administered by either federal or state government, where individuals and small business can purchase private insurance plans.<ref name=HealthCareGov/><ref name=aphabasics/><ref name=CohnExchanges/>Some exchanges, for example for MA and MN, also are the access point for Medicaid and expanded Medicaid coverage.<ref>{{Cite web|url=https://www.mass.gov/files/documents/2019/06/28/aca-3-english.pdf|title=Paper MA ACA application (for the MA Health Connector, the state exchange)|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref><ref>{{Cite web|url=https://edocs.dhs.state.mn.us/lfserver/Public/DHS-6696-ENG|title=MN ACA application (MNSURE, their state exchange)|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref> |

||

Setting up an exchange gives a state partial discretion on standards and prices of insurance.<ref name=KaiserExchangesNotes/><ref name=cwfstate/> For example, states approve plans for sale, and influence (through limits on and negotiations with private insurers) the prices on offer. They can impose higher or state-specific coverage requirements—including whether plans offered in the state can cover abortion.<ref>{{Cite news |url=http://www.rollcall.com/news/the_question_of_abortion_coverage_in_health_exchanges-226547-1.html |title=The Question of Abortion Coverage in Health Exchanges |last=Adams |first=Rebecca |date=July 22, 2013 |work=[[Roll Call]]}}</ref> States without an exchange do not have that discretion. The responsibility for operating their exchanges moves to the federal government.<ref name="KaiserExchangesNotes" /> |

Setting up an exchange gives a state partial discretion on standards and prices of insurance.<ref name=KaiserExchangesNotes/><ref name=cwfstate/> For example, states approve plans for sale, and influence (through limits on and negotiations with private insurers) the prices on offer. They can impose higher or state-specific coverage requirements—including whether plans offered in the state can cover abortion.<ref>{{Cite news |url=http://www.rollcall.com/news/the_question_of_abortion_coverage_in_health_exchanges-226547-1.html |title=The Question of Abortion Coverage in Health Exchanges |last=Adams |first=Rebecca |date=July 22, 2013 |work=[[Roll Call]]}}</ref> States without an exchange do not have that discretion. The responsibility for operating their exchanges moves to the federal government.<ref name="KaiserExchangesNotes" /> |

||

| Line 181: | Line 222: | ||

===Medicaid expansion=== |

===Medicaid expansion=== |

||

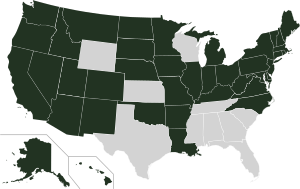

ACA revised and expanded [[Medicaid]] eligibility starting in 2014. Under the law as written, all U.S. citizens and legal residents with income up to 133% of the [[Poverty line in the United States#Measures of poverty|poverty line]], including adults without dependent children, would qualify for coverage in any state that participated in the Medicaid program. The federal government paid 100% of the cost of Medicaid eligibility expansion in participating states in 2014, 2015, and 2016; and will pay 95% in 2017, 94% in 2018, 93% in 2019, and 90% in 2020 and all subsequent years.<ref>{{cite news |author=HHS Press Office |date=March 29, 2013 |title=HHS finalizes rule guaranteeing 100 percent funding for new Medicaid beneficiaries |location=Washington, D.C. |publisher=U.S. Department of Health & Human Services |url=https://www.hhs.gov/news/press/2013pres/03/20130329a.html |accessdate=April 23, 2013 |quote=effective January 1, 2014, the federal government will pay 100 percent of defined cost of certain newly eligible adult Medicaid beneficiaries. These payments will be in effect through 2016, phasing down to a permanent 90 percent matching rate by 2020.}}<br />{{cite journal |author=Centers for Medicare & Medicaid Services |date=April 2, 2013 |title=Medicaid program: Increased federal medical assistance percentage changes under the Affordable Care Act of 2010: Final rule |journal=Federal Register |volume=78 |issue=63 |pages=19917–19947 |quote=(A) 100 percent, for calendar quarters in calendar years (CYs) 2014 through 2016; (B) 95 percent, for calendar quarters in CY 2017; (C) 94 percent, for calendar quarters in CY 2018; (D) 93 percent, for calendar quarters in CY 2019; (E) 90 percent, for calendar quarters in CY 2020 and all subsequent calendar years.}}</ref><ref>https://www.hhs.gov/news/press/2013pres/03/20130329a.html</ref><ref>{{Cite web|url=https://www.cbpp.org/research/how-health-reforms-medicaid-expansion-will-impact-state-budgets|title=How Health |

ACA revised and expanded [[Medicaid]] eligibility starting in 2014. Under the law as written, all U.S. citizens and legal residents with income up to 133% of the [[Poverty line in the United States#Measures of poverty|poverty line]], including adults without dependent children, would qualify for coverage in any state that participated in the Medicaid program. The federal government paid 100% of the cost of Medicaid eligibility expansion in participating states in 2014, 2015, and 2016; and will pay 95% in 2017, 94% in 2018, 93% in 2019, and 90% in 2020 and all subsequent years.<ref>{{cite news |author=HHS Press Office |date=March 29, 2013 |title=HHS finalizes rule guaranteeing 100 percent funding for new Medicaid beneficiaries |location=Washington, D.C. |publisher=U.S. Department of Health & Human Services |url=https://www.hhs.gov/news/press/2013pres/03/20130329a.html |accessdate=April 23, 2013 |quote=effective January 1, 2014, the federal government will pay 100 percent of defined cost of certain newly eligible adult Medicaid beneficiaries. These payments will be in effect through 2016, phasing down to a permanent 90 percent matching rate by 2020.}}<br />{{cite journal |author=Centers for Medicare & Medicaid Services |date=April 2, 2013 |title=Medicaid program: Increased federal medical assistance percentage changes under the Affordable Care Act of 2010: Final rule |journal=Federal Register |volume=78 |issue=63 |pages=19917–19947 |quote=(A) 100 percent, for calendar quarters in calendar years (CYs) 2014 through 2016; (B) 95 percent, for calendar quarters in CY 2017; (C) 94 percent, for calendar quarters in CY 2018; (D) 93 percent, for calendar quarters in CY 2019; (E) 90 percent, for calendar quarters in CY 2020 and all subsequent calendar years.}}</ref><ref>https://www.hhs.gov/news/press/2013pres/03/20130329a.html</ref><ref>{{Cite web|url=https://www.cbpp.org/research/how-health-reforms-medicaid-expansion-will-impact-state-budgets|title=How Health Reform's Medicaid Expansion Will Impact State Budgets|date=July 11, 2012|website=Center on Budget and Policy Priorities}}</ref> The law provides a 5% "income disregard", making the effective income eligibility limit for Medicaid 138% of the poverty level.<ref name=138fpl/> |

||

However, the [[Supreme Court of the United States|Supreme Court]] ruled in ''[[National Federation of Independent Business v. Sebelius|NFIB v. Sebelius]]'' that this provision of the ACA was coercive, and that the federal government must allow states to continue at pre-ACA levels of funding and eligibility if they chose. |

However, the [[Supreme Court of the United States|Supreme Court]] ruled in ''[[National Federation of Independent Business v. Sebelius|NFIB v. Sebelius]]'' that this provision of the ACA was coercive, and that the federal government must allow states to continue at pre-ACA levels of funding and eligibility if they chose. |

||

Expanded Medicaid (as well as the traditional Medicaids that existed prior to the ACA and continue to exist) are subject to [[Medicaid estate recovery]] for people 55 or older in many states. What can be recovered is all medical expenses that were paid out for a person while they had Medicaid or expanded Medicaid. The recovery is from a person's estate when they die, and applies only if they were 55 or older when they had the coverage<ref name=":5" /> <ref name=":6" /> <ref name=":7" /> . Some states amended laws and regulations since the passage of the ACA to stop the recovery as it relates to ordinary medical insurance coverage (that is, non-long-term-care related coverage),<ref name=":11">{{Cite web|url=https://www.health.ny.gov/health_care/medicaid/publications/gis/14ma016.htm|title=GIS 14 MA/016: Long Term Care Eligibility Rules and Estate Recovery Provisions for MAGI Individuals|website=www.health.ny.gov|access-date=2019-08-10}}</ref><ref name=":12">{{Cite web|url=https://ctmirror.org/2014/04/09/ct-scales-back-medicaid-repayment-rules-for-some-recipients/|title=CT scales back Medicaid repayment rules for some recipients|date=2014-04-09|website=The CT Mirror|language=en-US|access-date=2019-08-10}}</ref><ref name=":13">{{Cite web|url=https://www.medicaid.gov/State-resource-center/Medicaid-State-Plan-Amendments/Downloads/CT/CT-14-022.pdf|title=CT State Medicaid Plan Amendment 14-022|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref><ref name=":14">{{Cite web|url=http://blogs.seattletimes.com/healthcarecheckup/2013/12/16/state-will-change-asset-recovery-policy-for-medicaid-enrollees/|title=State will change asset recovery policy for Medicaid enrollees|last=Ostrom|first=Carol M.|website=The Seattle Times|access-date=2019-08-10}}</ref>,<ref name=":16">{{Cite web|url=https://www.oregonlive.com/finance/2013/12/cover_oregon_state_says_it_won.html|title=Cover Oregon: State says it won't pursue Oregon Health Plan recipients' assets|last=Hunsberger|first=Brent|date=2013-12-02|website=oregonlive.com|language=en-US|access-date=2019-08-10}}</ref><ref name=":17">{{Cite web|url=https://apps.state.or.us/Forms/Served/me9093.pdf|title=Oregon State Medicaid Estate Recovery Document|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref><ref name=":18">{{Cite web|url=https://www.mlstargazette.com/story/2017/05/18/news/minnesota-ma-estate-liens-put-to-final-rest/2269.html|title=Minnesota MA estate liens put to final rest|last=Gazette|first=Moose Lake Star|website=Moose Lake Star Gazette|access-date=2019-08-10}}</ref><ref name=":19">{{Cite web|url=https://mn.gov/dhs/people-we-serve/adults/health-care/health-care-programs/programs-and-services/estate-recovery.jsp|title=MN Medicaid Estate Recovery Document|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref> <ref name=":21">{{Cite web|url=https://www.hca.wa.gov/health-care-services-supports/program-administration/estate-recovery|title=Estate Recovery {{!}} Washington State Health Care Authority|website=www.hca.wa.gov|access-date=2019-08-10}}</ref><ref name=":22">{{Cite web|url=https://www.mass.gov/files/documents/2019/07/02/aca-1-english-mb.pdf|title=CA Medi-Cal Law Change (2017) Recovery Summary|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref>while others have not.<ref name=":23">{{Cite web|url=https://www.mass.gov/files/documents/2019/06/28/aca-3-english.pdf|title=MA ACA application (see (9) and (10) on adobe p. 22)|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref><ref name=":24">{{Cite web|url=https://www.mass.gov/files/documents/2016/07/ty/130-cmr-515-000.pdf|title=MassHealth General Policies (see 515.011 and 515.012)|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref> <ref name=":25">{{Cite web|url=https://www.mass.gov/files/documents/2019/07/02/aca-1-english-mb.pdf|title=MassHealth Booklet (describes varieties of Medicaid=MassHealth in MA. Needed for understanding regulations on estate recovery.)|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref> The issue is controversial<ref>{{Cite web|url=https://www.huffpost.com/entry/beware-of-the-medicaid-bi_b_10185884|title=Beware of the Medicaid 'Big Con'|last=Waldman|first=Deane|last2=ContributorDirector|date=2016-05-31|website=HuffPost|language=en|access-date=2019-08-10|last3=Center|first3=Texas Health Care Policy}}</ref><ref>{{Cite web|url=https://www.paulcraigroberts.org/2014/02/08/obamacare-final-payment-raiding-assets-low-income-poor-americans/|title=Obamacare: The Final Payment--Raiding the Assets of Low-Income and Poor Americans - PaulCraigRoberts.org|website=www.paulcraigroberts.org|language=en-US|access-date=2019-08-10}}</ref><ref>{{Cite web|url=https://www.pbs.org/newshour/show/medicaid-bill-doesnt-go-away-die|title=The Medicaid bill that doesn't go away when you die|date=2015-03-24|website=PBS NewsHour|language=en-us|access-date=2019-08-10}}</ref>.<br /> |

|||

===Medicare savings=== |

===Medicare savings=== |

||

| Line 231: | Line 274: | ||

In May 2011, Vermont enacted [[Green Mountain Care]], a state-based [[Single-payer health care|single-payer system]] for which they intended to pursue a waiver to implement.<ref name=VermontGMC1/><ref name=VermontGMC2/><ref name=VermontGMC3/> In December 2014, Vermont decided not to continue due to high expected costs.<ref>{{cite news |url=https://www.bostonglobe.com/business/2015/01/25/costs-derail-vermont-single-payer-health-plan/VTAEZFGpWvTen0QFahW0pO/story.html |title=Costs derail Vermont's single-payer health plan |newspaper=The Boston Globe}}</ref> |

In May 2011, Vermont enacted [[Green Mountain Care]], a state-based [[Single-payer health care|single-payer system]] for which they intended to pursue a waiver to implement.<ref name=VermontGMC1/><ref name=VermontGMC2/><ref name=VermontGMC3/> In December 2014, Vermont decided not to continue due to high expected costs.<ref>{{cite news |url=https://www.bostonglobe.com/business/2015/01/25/costs-derail-vermont-single-payer-health-plan/VTAEZFGpWvTen0QFahW0pO/story.html |title=Costs derail Vermont's single-payer health plan |newspaper=The Boston Globe}}</ref> |

||

A number of states have implemented, or are planning to implement, work-requirement waivers for Medicaid, affecting ACE expanded Medicaid, as well.<ref>{{Cite web|url=https://www.kff.org/medicaid/issue-brief/medicaid-waiver-tracker-approved-and-pending-section-1115-waivers-by-state/|title=Medicaid Waiver Tracker: Approved and Pending Section 1115 Waivers by State|last=Aug 09|first=Published:|last2=2019|date=2019-08-09|website=The Henry J. Kaiser Family Foundation|language=en-us|access-date=2019-08-20}}</ref> |

|||

===Other insurance provisions=== |

===Other insurance provisions=== |

||

| Line 237: | Line 282: | ||

===Menu calorie listings=== |

===Menu calorie listings=== |

||

[[Nutrition labeling requirements of the Affordable Care Act]] were signed into federal law in 2010, but implementation was delayed by the FDA several times until they went into effect on May 7, 2018.<ref>{{Cite web|url=https://wreg.com/2018/05/07/affordable-care-acts-calorie-count-rules-go-into-effect/|title=Affordable Care |

[[Nutrition labeling requirements of the Affordable Care Act]] were signed into federal law in 2010, but implementation was delayed by the FDA several times until they went into effect on May 7, 2018.<ref>{{Cite web|url=https://wreg.com/2018/05/07/affordable-care-acts-calorie-count-rules-go-into-effect/|title=Affordable Care Act's calorie count rules go into effect|date=May 7, 2018}}</ref> |

||

==Legislative history== |

==Legislative history== |

||

| Line 321: | Line 367: | ||

===Coverage=== |

===Coverage=== |

||

{{See also|Health insurance coverage in the United States}} |

{{See also|Health insurance coverage in the United States}} |

||

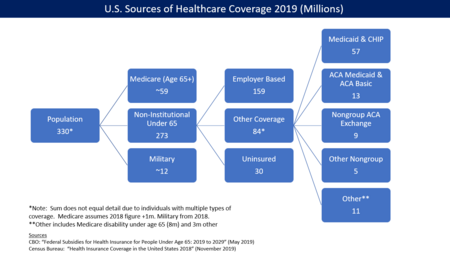

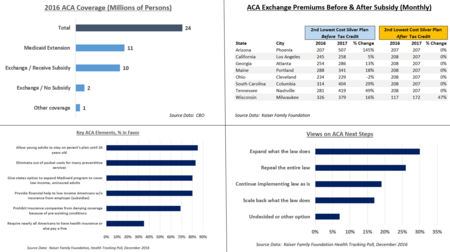

The law has caused a significant reduction in the number and percentage of people without health insurance. The CDC reported that the percentage of people without health insurance fell from 16.0% in 2010 to 8.9% from January to June 2016.<ref name=CDC1>{{Cite web |url=https://www.cdc.gov/nchs/data/nhis/earlyrelease/earlyrelease201611_01.pdf |title=National Health Interview Survey, January to June 2016 |website=CDC.gov |accessdate=November 23, 2016}}</ref> The uninsured rate dropped in every congressional district in the U.S. from 2013 to 2015.<ref name="FiveThirtyEight - uninsured rate">{{cite news |last1=Barry-Jester |first1=Anna Maria |last2=Ben |first2=Casselman |title=Obamacare Has Increased Insurance Coverage Everywhere |url=http://fivethirtyeight.com/features/obamacare-has-increased-insurance-coverage-everywhere/ |accessdate=October 12, 2016 |work=FiveThirtyEight |date=September 22, 2016}}</ref> The [[Congressional Budget Office]] reported in March 2016 that there were approximately 12 million people covered by the exchanges (10 million of whom received subsidies to help pay for insurance) and 11 million made eligible for Medicaid by the law, a subtotal of 23 million people. An additional 1 million were covered by the ACA's "Basic Health Program," for a total of 24 million.<ref name=CBO_Subsidy2016>{{Cite web |url=https://www.cbo.gov/publication/51385 |title=Federal Subsidies for Health Insurance Coverage for People Under Age 65:2016 to 2026 |website=CBO |accessdate=November 23, 2016}}</ref> CBO also estimated that the ACA would reduce the net number of uninsured by 22 million in 2016, using a slightly different computation for the above figures totaling ACA coverage of 26 million, less 4 million for reductions in "employment-based coverage" and "non-group and other coverage."<ref name=CBO_Subsidy2016/> |

The law has caused a significant reduction in the number and percentage of people without health insurance. The CDC reported that the percentage of people without health insurance fell from 16.0% in 2010 to 8.9% from January to June 2016.<ref name=CDC1>{{Cite web |url=https://www.cdc.gov/nchs/data/nhis/earlyrelease/earlyrelease201611_01.pdf |title=National Health Interview Survey, January to June 2016 |website=CDC.gov |accessdate=November 23, 2016}}</ref> The uninsured rate dropped in every congressional district in the U.S. from 2013 to 2015.<ref name="FiveThirtyEight - uninsured rate">{{cite news |last1=Barry-Jester |first1=Anna Maria |last2=Ben |first2=Casselman |title=Obamacare Has Increased Insurance Coverage Everywhere |url=http://fivethirtyeight.com/features/obamacare-has-increased-insurance-coverage-everywhere/ |accessdate=October 12, 2016 |work=FiveThirtyEight |date=September 22, 2016}}</ref> The [[Congressional Budget Office]] reported in March 2016 that there were approximately 12 million people covered by the exchanges (10 million of whom received subsidies to help pay for insurance) and 11 million made eligible for Medicaid by the law, a subtotal of 23 million people. An additional 1 million were covered by the ACA's "Basic Health Program," for a total of 24 million.<ref name=CBO_Subsidy2016>{{Cite web |url=https://www.cbo.gov/publication/51385 |title=Federal Subsidies for Health Insurance Coverage for People Under Age 65:2016 to 2026 |website=CBO |accessdate=November 23, 2016}}</ref> CBO also estimated that the ACA would reduce the net number of uninsured by 22 million in 2016, using a slightly different computation for the above figures totaling ACA coverage of 26 million, less 4 million for reductions in "employment-based coverage" and "non-group and other coverage."<ref name=CBO_Subsidy2016/> |

||

(In all discussion of uninsured rates, and changes in uninsured rates due to the ACA, in many states, people 55 or older with either Medicaid, and/or expanded Medicaid, are subject to [[Medicaid estate recovery]]<ref name=":7" /><ref name=":6" /><ref name=":5" /> of all medical expenses paid for them while they were receiving Medicaid or expanded Medicaid. Thus, some people in those programs we might think of as actually not having insurance, in the sense that we usually think of insurance, but rather as having a loan for medical expenses until death. However, the U.S. Census Bureau counts all people with Medicaid and expanded Medicaid as insured,<ref>{{Cite web|url=https://www.census.gov/content/dam/Census/library/publications/2018/demo/p60-264.pdf|title=Health Insurance Coverage in the United States: 2017|last=|first=|date=2019-08-10|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref> which will be reflected in the insured numbers appearing here, and which we thus may wish to think of as not truly representative of the number we are desiring to measure.) |

|||

The [[United States Department of Health and Human Services|U.S. Department of Health and Human Services]] (HHS) estimated that 20.0 million adults (aged 18–64) gained healthcare coverage via ACA as of February 2016, a 2.4 million increase over September 2015;<ref name="HHS_ASPE16" /> similarly, the [[Urban Institute]] found in 2016 that 19.2 million non-elderly Americans gained health insurance coverage from 2010 to 2015.<ref>{{cite web |url=http://www.urban.org/sites/default/files/publication/86761/2001041-who-gained-health-insurance-coverage-under-the-aca-and-where-do-they-live.pdf |title=Who Gained Health Insurance Coverage Under the ACA, and Where Do They Live? |work=Urban Institute |date=December 2016 |accessdate=22 April 2017 |author=Garrett, Bowen |pages=2}}</ref> In 2016, the CBO estimated the uninsured at approximately 27 million people, or around 10% of the population or 7–8% excluding unauthorized immigrants.<ref name=CBO_Subsidy2016/> |

The [[United States Department of Health and Human Services|U.S. Department of Health and Human Services]] (HHS) estimated that 20.0 million adults (aged 18–64) gained healthcare coverage via ACA as of February 2016, a 2.4 million increase over September 2015;<ref name="HHS_ASPE16" /> similarly, the [[Urban Institute]] found in 2016 that 19.2 million non-elderly Americans gained health insurance coverage from 2010 to 2015.<ref>{{cite web |url=http://www.urban.org/sites/default/files/publication/86761/2001041-who-gained-health-insurance-coverage-under-the-aca-and-where-do-they-live.pdf |title=Who Gained Health Insurance Coverage Under the ACA, and Where Do They Live? |work=Urban Institute |date=December 2016 |accessdate=22 April 2017 |author=Garrett, Bowen |pages=2}}</ref> In 2016, the CBO estimated the uninsured at approximately 27 million people, or around 10% of the population or 7–8% excluding unauthorized immigrants.<ref name=CBO_Subsidy2016/> |

||

| Line 385: | Line 433: | ||

Insurance coverage helps save lives, by encouraging early detection and prevention of dangerous medical conditions. According to a 2014 study, the ACA likely prevented an estimated 50,000 preventable patient deaths from 2010 to 2013.<ref name="WaPo_Covg">{{Cite web |url=https://www.washingtonpost.com/news/fact-checker/wp/2015/04/01/obamas-claim-the-affordable-care-act-was-a-major-reason-in-preventing-50000-patient-deaths/ |title=Obama's claim the Affordable Care Act was a 'major reason' in preventing 50,000 patient deaths |website=Washington Post |accessdate=November 10, 2016}}</ref> [[City University of New York|City University]] public health professors David Himmelstein and Steffie Woolhandler wrote in January 2017 that a rollback of the ACA's Medicaid expansion alone would cause an estimated 43,956 deaths annually.<ref>{{Cite web |url=https://www.washingtonpost.com/posteverything/wp/2017/01/23/repealing-the-affordable-care-act-will-kill-more-than-43000-people-annually/ |title=Repealing the Affordable Care Act will kill more than 43,000 people annually |website=Washington Post|access-date=2017-01-23}}</ref> |

Insurance coverage helps save lives, by encouraging early detection and prevention of dangerous medical conditions. According to a 2014 study, the ACA likely prevented an estimated 50,000 preventable patient deaths from 2010 to 2013.<ref name="WaPo_Covg">{{Cite web |url=https://www.washingtonpost.com/news/fact-checker/wp/2015/04/01/obamas-claim-the-affordable-care-act-was-a-major-reason-in-preventing-50000-patient-deaths/ |title=Obama's claim the Affordable Care Act was a 'major reason' in preventing 50,000 patient deaths |website=Washington Post |accessdate=November 10, 2016}}</ref> [[City University of New York|City University]] public health professors David Himmelstein and Steffie Woolhandler wrote in January 2017 that a rollback of the ACA's Medicaid expansion alone would cause an estimated 43,956 deaths annually.<ref>{{Cite web |url=https://www.washingtonpost.com/posteverything/wp/2017/01/23/repealing-the-affordable-care-act-will-kill-more-than-43000-people-annually/ |title=Repealing the Affordable Care Act will kill more than 43,000 people annually |website=Washington Post|access-date=2017-01-23}}</ref> |

||

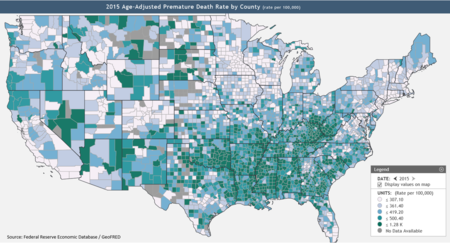

The Federal Reserve publishes data on premature death rates by county, defined as those dying below age 74.<ref name="FRED_Map1">{{Cite web|url=https://fredblog.stlouisfed.org/2017/11/theres-death-and-then-theres-death/|title= |

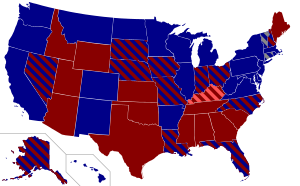

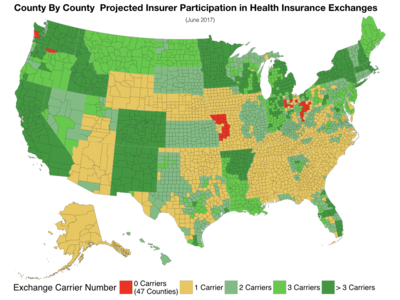

The Federal Reserve publishes data on premature death rates by county, defined as those dying below age 74.<ref name="FRED_Map1">{{Cite web|url=https://fredblog.stlouisfed.org/2017/11/theres-death-and-then-theres-death/|title=There's death and then there's death | FRED Blog}}</ref> According to the Kaiser Foundation, expanding Medicaid in the remaining 19 states would cover up to 4.5 million persons.<ref name="Kaiser_Gap">{{Cite web|url=https://www.kff.org/medicaid/issue-brief/the-coverage-gap-uninsured-poor-adults-in-states-that-do-not-expand-medicaid/|title=The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid|date=March 21, 2019}}</ref> Since expanding Medicaid expands coverage<ref name="Kaiser_Gap"/> and expanding coverage reduces mortality,<ref name="WaPo_Covg"/> therefore expanding Medicaid reduces mortality by [[syllogism]]. Texas, Oklahoma, Mississippi, Alabama, Georgia, Tennessee, Missouri and South Carolina, indicated on the map at right as having many counties with high premature mortality rates,<ref name="FRED_Map1"/> could therefore reduce mortality by expanding Medicaid, other things equal. |

||

Two 2018 ''[[JAMA (journal)|JAMA]]'' studies found the Hospital Readmissions Reduction Program was associated with increased post-discharge mortality for patients hospitalized for heart failure and pneumonia.<ref>{{Cite journal|last=Fonarow|first=Gregg C.|last2=Yancy|first2=Clyde W.|last3=Matsouaka|first3=Roland A.|last4=Peterson|first4=Eric D.|last5=Hernandez|first5=Adrian F.|last6=Heidenreich|first6=Paul A.|last7=DeVore|first7=Adam D.|last8=Cox|first8=Margueritte|last9=Bhatt|first9=Deepak L.|date=2018-01-01|title=Association of the Hospital Readmissions Reduction Program Implementation With Readmission and Mortality Outcomes in Heart Failure|url=https://jamanetwork.com/journals/jamacardiology/fullarticle/2663213|journal=JAMA Cardiology|language=en|volume=3|issue=1|pages=44–53|doi=10.1001/jamacardio.2017.4265|pmc=5833526|issn=2380-6583}}</ref><ref>{{Cite journal|last=Yeh|first=Robert W.|last2=Shen|first2=Changyu|last3=Haneuse|first3=Sebastien|last4=Wasfy|first4=Jason H.|last5=Maddox|first5=Karen E. Joynt|last6=Wadhera|first6=Rishi K.|date=2018-12-25|title=Association of the Hospital Readmissions Reduction Program With Mortality Among Medicare Beneficiaries Hospitalized for Heart Failure, Acute Myocardial Infarction, and Pneumonia|url=https://jamanetwork.com/journals/jama/fullarticle/2719307|journal=JAMA|language=en|volume=320|issue=24|pages=2542–2552|doi=10.1001/jama.2018.19232|issn=0098-7484}}</ref><ref>{{Cite web|url=https://reason.com/2018/12/27/it-sure-looks-like-this-obamacare-progra/|title=It Sure Looks Like This Obamacare Program Has Led to More People Dying|date=2018-12-27|website=Reason.com|language=en-US|access-date=2019-06-06}}</ref> A 2019 ''JAMA'' study found that the ACA decreased emergency department and hospital use by uninsured individuals.<ref>{{Cite journal|last=Pines|first=Jesse M.|last2=Thode|first2=Henry C.|last3=Singer|first3=Adam J.|date=2019-04-05|title=US Emergency Department Visits and Hospital Discharges Among Uninsured Patients Before and After Implementation of the Affordable Care Act|url=https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2730788|journal=JAMA Network Open|language=en|volume=2|issue=4|pages=e192662|doi=10.1001/jamanetworkopen.2019.2662}}</ref> |

Two 2018 ''[[JAMA (journal)|JAMA]]'' studies found the Hospital Readmissions Reduction Program was associated with increased post-discharge mortality for patients hospitalized for heart failure and pneumonia.<ref>{{Cite journal|last=Fonarow|first=Gregg C.|last2=Yancy|first2=Clyde W.|last3=Matsouaka|first3=Roland A.|last4=Peterson|first4=Eric D.|last5=Hernandez|first5=Adrian F.|last6=Heidenreich|first6=Paul A.|last7=DeVore|first7=Adam D.|last8=Cox|first8=Margueritte|last9=Bhatt|first9=Deepak L.|date=2018-01-01|title=Association of the Hospital Readmissions Reduction Program Implementation With Readmission and Mortality Outcomes in Heart Failure|url=https://jamanetwork.com/journals/jamacardiology/fullarticle/2663213|journal=JAMA Cardiology|language=en|volume=3|issue=1|pages=44–53|doi=10.1001/jamacardio.2017.4265|pmid=29128869|pmc=5833526|issn=2380-6583}}</ref><ref>{{Cite journal|last=Yeh|first=Robert W.|last2=Shen|first2=Changyu|last3=Haneuse|first3=Sebastien|last4=Wasfy|first4=Jason H.|last5=Maddox|first5=Karen E. Joynt|last6=Wadhera|first6=Rishi K.|date=2018-12-25|title=Association of the Hospital Readmissions Reduction Program With Mortality Among Medicare Beneficiaries Hospitalized for Heart Failure, Acute Myocardial Infarction, and Pneumonia|url=https://jamanetwork.com/journals/jama/fullarticle/2719307|journal=JAMA|language=en|volume=320|issue=24|pages=2542–2552|doi=10.1001/jama.2018.19232|issn=0098-7484}}</ref><ref>{{Cite web|url=https://reason.com/2018/12/27/it-sure-looks-like-this-obamacare-progra/|title=It Sure Looks Like This Obamacare Program Has Led to More People Dying|date=2018-12-27|website=Reason.com|language=en-US|access-date=2019-06-06}}</ref> A 2019 ''JAMA'' study found that the ACA decreased emergency department and hospital use by uninsured individuals.<ref>{{Cite journal|last=Pines|first=Jesse M.|last2=Thode|first2=Henry C.|last3=Singer|first3=Adam J.|date=2019-04-05|title=US Emergency Department Visits and Hospital Discharges Among Uninsured Patients Before and After Implementation of the Affordable Care Act|url=https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2730788|journal=JAMA Network Open|language=en|volume=2|issue=4|pages=e192662|doi=10.1001/jamanetworkopen.2019.2662}}</ref> |

||

===Distributional impact=== |

===Distributional impact=== |

||

| Line 440: | Line 488: | ||

Between January 2010 and 2015, a quarter of emergency room doctors said they had seen a major surge in patients, while nearly half had seen a smaller increase. Seven in ten ER doctors claimed that they lacked the resources to deal with large increases in the number of patients. The biggest factor in the increased number of ER patients was insufficient primary care providers to handle the larger number of insured patients.<ref>{{cite news |url=http://www.washingtontimes.com/news/2015/may/4/er-visits-under-obamacare-doctors-say/#ixzz3ZH4xpm5H |title=ER visits up under Obamacare despite promises, doctors' poll finds |first=Tom Jr. |last=Howell |work=The Washington Times |date=May 4, 2015 |accessdate=May 6, 2015}}</ref> |

Between January 2010 and 2015, a quarter of emergency room doctors said they had seen a major surge in patients, while nearly half had seen a smaller increase. Seven in ten ER doctors claimed that they lacked the resources to deal with large increases in the number of patients. The biggest factor in the increased number of ER patients was insufficient primary care providers to handle the larger number of insured patients.<ref>{{cite news |url=http://www.washingtontimes.com/news/2015/may/4/er-visits-under-obamacare-doctors-say/#ixzz3ZH4xpm5H |title=ER visits up under Obamacare despite promises, doctors' poll finds |first=Tom Jr. |last=Howell |work=The Washington Times |date=May 4, 2015 |accessdate=May 6, 2015}}</ref> |

||

Insurers claimed that because they have access to and collect patient data that allow evaluations of interventions, they are essential to ACO success. Large insurers formed their own ACOs. Many hospitals merged and purchased physician practices. The increased market share gave them more leverage in negotiations with insurers over costs and reduced patient care options.<ref name=":15" /> |

Insurers claimed that because they have access to and collect patient data that allow evaluations of interventions, they are essential to ACO success. Large insurers formed their own ACOs. Many hospitals merged and purchased physician practices. The increased market share gave them more leverage in negotiations with insurers over costs and reduced patient care options.<ref name=":15" /><br /> |

||

== Problems == |

|||

=== Subsidy Cliff at 400% FPL === |

|||

The subsidies for an ACA plan purchased on an exchange stop at 400% of the Federal Poverty Level (FPL). This results in a sharp "discontinuity of treatment" at 400% FPL, which is sometimes called the "subsidy cliff".<ref>{{Cite web|url=https://www.ehealthinsurance.com/resources/individual-and-family/what-is-the-subsidy-cliff|title=Are You On the Edge of the ACA Subsidy Cliff? - eHealth Insurance|date=2019-07-31|website=eHealth Insurance Resource Center|language=en-US|access-date=2019-08-10}}</ref>People above the subsidy cliff can experience a sharp rise in premiums, making the premiums unaffordable.<ref name=":31">{{Cite web|url=https://money.cnn.com/2016/11/04/news/economy/obamacare-affordable/index.html|title=Is Obamacare actually affordable?|last=Luhby|first=Tami|date=2016-11-04|website=CNNMoney|access-date=2019-08-22}}</ref><ref name=":32">{{Cite web|url=https://khn.org/news/health-insurance-costs-crushing-many-people-who-dont-get-federal-subsidies/|title=Health Insurance Costs Crushing Many People Who Don’t Get Federal Subsidies|last=Findlay|first=Steven|date=2018-12-14|website=Kaiser Health News|language=en-US|access-date=2019-08-22}}</ref>. |

|||

After-subsidy premiums for the second lowest cost silver plan (SCLSP) just below the cliff are 9.86% of Modified Adjusted Gross Income (MAGI) in 2019<ref name=":8" />. However, upon crossing the cliff, the cost of the plan may rise sharply. |

|||

'''Silver plan numbers example''': For example, in Cook County, IL zip 60617, in 2019, one gets from Healthcare.gov<ref name=":26">{{Cite web|url=https://www.healthcare.gov/see-plans/|title=Health insurance plans & prices|website=HealthCare.gov|language=en|access-date=2019-08-10}}</ref> a SCLSP rate of $21,266 for a married couple 63 years of age. If the couple's income is 401% of the FPL<ref>{{Cite web|url=https://aspe.hhs.gov/poverty-guidelines|title=Poverty Guidelines|date=2015-11-23|website=ASPE|language=en|access-date=2019-08-11}}</ref>, just above the cliff, that works out to $84, 731. If the couple chooses the SCLSP, it will cost them 25.1% of their Modified Adjusted Gross Income. If their MAGI was 399% of the FPL (i.e. not over the cliff) at $84,308, the SCLSP would only have costed them 9.86% of their MAGI, or $8,312. The jump in cost at the discontinuity is $12,954. |

|||