Payment card: Difference between revisions

Enthusiast01 (talk | contribs) |

Enthusiast01 (talk | contribs) |

||

| Line 31: | Line 31: | ||

Debit cards can also allow for instant withdrawal of cash, acting as the [[ATM card]], and as a [[cheque guarantee card]]. Merchants can also offer "cashback"/"cashout" facilities to customers, where a customer can withdraw cash along with their purchase. |

Debit cards can also allow for instant withdrawal of cash, acting as the [[ATM card]], and as a [[cheque guarantee card]]. Merchants can also offer "cashback"/"cashout" facilities to customers, where a customer can withdraw cash along with their purchase. |

||

==ATM card== |

|||

An [[ATM card]] (known under a number of names) is a card issued by a [[financial institution]] that can be used in an [[automated teller machine]] (ATM) for transactions such as: deposits, cash withdrawals, obtaining account information, and other types of transactions, often through [[interbank network]]s. Debit or credit cards may also act as ATM cards. |

|||

===Charge card=== |

===Charge card=== |

||

Revision as of 09:13, 28 February 2013

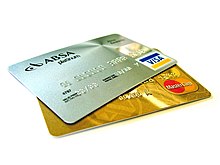

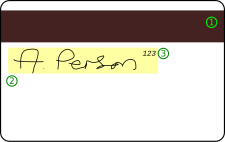

- Issuing bank logo

- EMV chip

- Hologram

- Card number

- Card brand logo

- Expiration date

- Cardholder's name

A payment card is a card that can be used by a cardholder and accepted by a merchant to make a payment for a purchase or in payment of some other obligation.

There are several types of payment cards in the marketplace which have several features in common. Payment cards are embossed plastic cards which are 85.60 × 53.98 mm in size, complying with ISO/IEC 7810 ID-1 standard. They also have an embossed bank card number conforming with the ISO/IEC 7812 numbering standard.

Types

Typically, a payment card is electronically linked to an account or accounts belonging to the cardholder. These accounts may be deposit accounts or loan or credit accounts. There are a number of payment cards including:

Credit card

A feature of a credit card is that the issuer of the card creates a line of credit for the consumer (or the cardholder) which the cardholder can draw on (ie., borrow) for payment to a merchant in making a purchase or as a cash advance to the cardholder. Most credit cards are issued by or through local banks or credit unions, but some credit card companies offer cards directly to the public.

A credit card is different from a charge card, where a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers to 'revolve' their balance, at the cost of having interest charged.

Debit card

A feature of a debit card (also known as a bank card or check card) is that when a cardholder makes a purchase funds are withdrawn directly from either the bank account, or from the remaining balance on the card. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card.[1][2]

The use of debit cards has become widespread in many countries and has overtaken use of cheques, and in some instances cash transactions by volume. Like credit cards, debit cards are used widely for telephone and Internet purchases, and unlike credit cards the funds are transferred from the bearer's bank account instead of having the bearer to pay back on a later date.

Debit cards can also allow for instant withdrawal of cash, acting as the ATM card, and as a cheque guarantee card. Merchants can also offer "cashback"/"cashout" facilities to customers, where a customer can withdraw cash along with their purchase.

ATM card

An ATM card (known under a number of names) is a card issued by a financial institution that can be used in an automated teller machine (ATM) for transactions such as: deposits, cash withdrawals, obtaining account information, and other types of transactions, often through interbank networks. Debit or credit cards may also act as ATM cards.

Charge card

A charge card is similar to a credit card, except that the cardholder is required to pay the full balance of the statement amount, which is usually monthly. It is a means of obtaining a very short term loan for a purchase. The period of the loan is the period between the purchase and the statement date plus the period that the cardholder has to pay the account, a potential period of usually up to 55 days. Since there is no loan, there is no official interest. A partial payment (or no payment) may result in a severe late fee (as much as 5% of the balance) and the possible restriction of future transactions and a potential cancellation of the card.

Stored-value card

A stored-value card refers to monetary value on a card not in an externally recorded account and differs from prepaid cards where money is on deposit with the issuer similar to a debit card. One major difference between stored value cards and prepaid debit cards is that prepaid debit cards are usually issued in the name of individual account holders, while stored value cards are usually anonymous.

The term stored-value card means the funds and or data are physically (materially, with mass) stored on the card. With prepaid cards the data is maintained on computers affiliated with the card issuer. The value associated with the card can be accessed using a magnetic stripe embedded in the card, on which the card number is encoded; using radio-frequency identification (RFID); or by entering a code number, printed on the card, into a telephone or other numeric keypad.

Fleet card

A fleet card is used as a payment card most commonly for gasoline, diesel and other fuels at gas stations. Fleet cards can also be used to pay for vehicle maintenance and expenses at the discretion of the fleet owner or manager. The use of a fleet card also eliminates the need for cash carrying, thus increasing the level of security felt by fleet drivers. The elimination of cash also makes it easier to prevent fraudulent transactions from occurring at a fleet owner or manager’s expense.

Fleet cards are unique due to the convenient and comprehensive reporting that accompanies their use. Fleet cards enable fleet owners/managers to receive real time reports and set purchase controls with their cards helping them to stay informed of all business related expenses.

Other

Other types of payment cards include:

Technologies

Magnetic stripe card

A magnetic stripe card is a type of card capable of storing data by modifying the magnetism of tiny iron-based magnetic particles on a band of magnetic material on the card. The magnetic stripe, sometimes called a magstripe, is read by physical contact and swiping past a reading head. Magnetic stripe cards are commonly used in credit cards, identity cards, and transportation tickets. They may also contain an RFID tag, a transponder device and/or a microchip mostly used for business premises access control or electronic payment.

A number of International Organization for Standardization standards, ISO/IEC 7810, ISO/IEC 7811, ISO/IEC 7812, ISO/IEC 7813, ISO 8583, and ISO/IEC 4909, define the physical properties of the card, including size, flexibility, location of the magstripe, magnetic characteristics, and data formats. They also provide the standards for financial cards, including the allocation of card number ranges to different card issuing institutions.

Smart card

A smart card, chip card, or integrated circuit card (ICC), is any pocket-sized card with embedded integrated circuits which can process data. This implies that it can receive input which is processed — by way of the ICC applications — and delivered as an output. There are two broad categories of ICCs. Memory cards contain only non-volatile memory storage components, and perhaps some specific security logic. Microprocessor cards contain volatile memory and microprocessor components. The card is made of plastic, generally PVC, but sometimes ABS. The card may embed a hologram to avoid counterfeiting. Using smart cards is also a form of strong security authentication for single sign-on within large companies and organizations.

EMV is the standard adopted by all major issuers of smart payment cards.[citation needed]

Proximity card

Proximity card (or prox card) is a generic name for contactless integrated circuit devices used for security access or payment systems. It can refer to the older 125 kHz devices or the newer 13.56 MHz contactless RFID cards, most commonly known as contactless smartcards.

Modern proximity cards are covered by the ISO/IEC 14443 (proximity card) standard. There is also a related ISO/IEC 15693 (vicinity card) standard. Proximity cards are powered by resonant energy transfer and have a range of 0-3 inches in most instances. The user will usually be able to leave the card inside a wallet or purse. The price of the cards is also low, usually US$2–$5, allowing them to be used in applications such as identification cards, keycards, payment cards and public transit fare cards.

Re-programmable magnetic stripe card

Re-programmable/dynamic magnetic stripe cards are standard sized transaction cards that include a battery, a processor, and a means (inductive coupling or otherwise)of sending a variable signal to a magnetic stripe reader. Re-programmable stripe cards are often more secure than standard magnetic stripe cards and can transmit information for multiple cardholder accounts.[3]

See also

- ATM card

- Credit card fraud

- Payments as a platform

- Payment card industry

- Payment gateway

- Payment system

- Payoneer

- Payment Services Directive

- Prepayment for service